As many as 3 million New Yorkers may be fraudulently reaping taxpayer-funded Medicaid and other public health insurance benefits at a potential cost of $20 billion a year, a staggering new study claims.

About 5.5 million Empire State residents have incomes low enough to meet the standard eligibility limits for Medicaid or the Essential Plan, a related public health insurance program. But with expanded eligibility rules under Obamacare and an increased demand for a controversial homecare program, enrollment has swelled to 8.5 million, a potential surplus of 3 million.

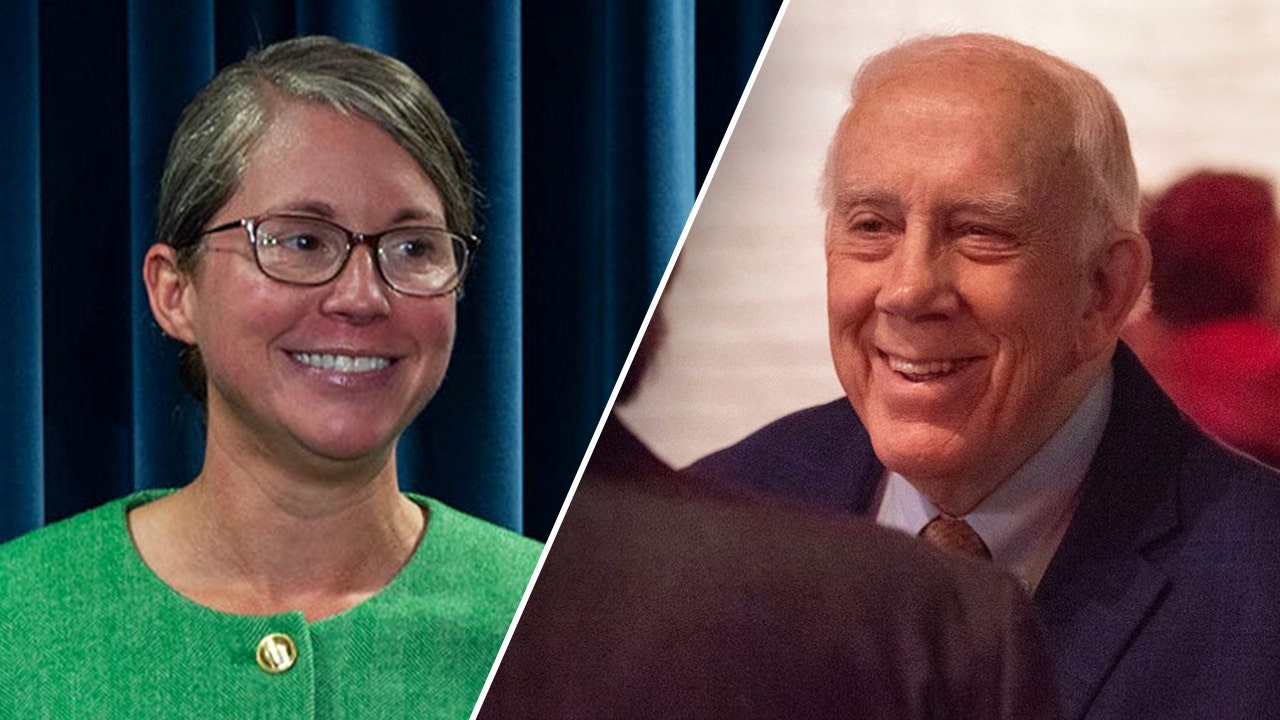

“It raises the question of whether there is widespread fraud,” said Bill Hammond, the Empire Center’s senior fellow for health policy who drafted the report published Tuesday.

The report says about 44% of state residents — including 60% of those in New York City — are covered by Medicaid or the Essential Plan, seven points above any other state. The programs take up a large share of the state budget.

“The overuse of taxpayer-funded insurance harms the state in multiple ways. Most obvious is the added burden on taxpayers. Even assuming most of the 3 million excess enrollees are non-disabled adults and children, they could be costing Medicaid $20 billion or more per year,” the study said.

It added that one-third of those getting taxpayer-funded coverage are earning more than the standard income limits.

Some higher earners can skirt Medicaid’s eligibility limits through legal maneuvering, like putting income into a trust fund managed by a person on behalf of the would-be Medicaid enrollee, the report noted.

The report also blamed state officials for the ballooning enrollment — saying the creation of the Essential Plan extended coverage up to 250% of the federal poverty level.

New York state’s Medicaid fraud by the numbers:

- 44%: Percent of New York’s population on Medicaid or other public insurance

- 7 points: How much higher that percentage is than any other state; double the national average

- 3 million: Estimated number of people collecting Medicaid despite being ineligible

- $20 billion: Estimate of how much Medicaid pays out fraudulently in New York annually

The federal eligibility requirements and vetting were also loosened during and after the COVID-19 pandemic, when many people were unemployed.

In addition, the booming popularity of the Consumer Directed Personal Assistance Program — a $6 billion state Medicaid program that allows residents with zero healthcare experience to get paid for caring for their elderly or disabled relatives and friends — has also contributed to the Medicaid bloat. Critics say CDPAP is rife with fraud and waste with very little oversight.

The state pitches in $38 billion to Medicaid — a cost that has soared by $10 billion, or 36%, in just the past three years, the report said. That figure is more than state funding for public schools, previously the largest portion of the state budget. The share of Medicaid costs financed by state taxpayers has jumped by 53% over the past five years and currently consumes about 28% of all state operating funds.

“New York should stop abusing Medicaid as a catch-all insurance plan for almost half the state’s population,” said Hammond.

“Instead, it should refocus the program on its original and most important purpose, which is to provide care for those who cannot help themselves.”

The massive number of people on public health insurance — including those with moderate incomes — hurts the private insurance market, the report said.

The Medicaid rolls surged after former President Barack Obama approved the Affordable Care Act to reduce the number of Americans who were uninsured or under-insured. The law encouraged more people to enroll in Medicaid as well as the private market, or exchanges.

The number of uninsured residents plummeted. But the report says the number of New Yorkers in Medicaid and the Essential Plan swelled much higher than the drop of uninsured residents.

Hammond said it’s not unusual for people who are on Medicaid and also obtain private health insurance.

Asked to comment on the report’s findings, Gov. Kathy Hochul’s office said she “has prioritized fiscal responsibility while still delivering the services New Yorkers need.

“The Governor has fought to keep a robust $20.5 billion in reserves ready for a ‘rainy day,’ and we remain laser focused on ensuring taxpayer dollars are used responsibly,” the statement said.